Under The Radar

About

We speak with businesses, industry leaders, venture capitalists and startups on their assessment of the business environment they're in, and what the future holds for them.

MAY 29, 2025

29/05/25 - Under the Radar: (SPECIALS) What to watch at OpenAI’s 1st Forum in Asia, and what to know about its museum partnership with the Peranakan Museum

Money Matter’s finance presenter Chua Tian Tian was at Sentosa to attend the Asia Tech x Singapore or ATx Summit held at Capella Singapore.

Organised by the Infocomm Media Development Authority of Singapore or the IMDA, the event covers a range of topics such as agentic and embodied AI, space satellite and communications, quantum compute and digital sustainability through a series of plenary sessions.

There is also a variety of forums and roundtables to facilitate closer partnerships between the public sector and the digital industry.

Among them, is the first OpenAI Forum in Asia. The series is aimed at sparking thoughtful dialogue on how AI can enhance culture, society, and everyday life.

The forum session dived into OpenAI’s first ever museum partnership in Asia, with the Peranakan Museum and in collaboration with Ask Mona, a French AI studio that specialises in cultural experiences.

In a pilot collaboration, they came up with ways for museum visitors to speak to artifacts like a kamcheng jar or the traditional Peranakan attire using AI-generated conversations, and provide a fresh and interactive way to connect people with heritage ahead of Singapore’s SG60 celebrations.

Tian Tian found out more about the experience from Sandy Kunvatanagarn, Head of APAC Policy at OpenAI.

|

|

|

|

06:50

|

MAY 28, 2025

28/05/25 - Under the Radar: (SPECIALS) What should we know about the rejuvenation of Smith Street in Chinatown? The director of business planning at Singapore Land Authority spills the beans. (Part 2 – What to watch in the refreshed Smith Street?)

In November 2023, the Singapore Land Authority, the Singapore Tourism Board, and the Urban Redevelopment Authority launched a collective tender to appoint a master tenant to rejuvenate a row of shophouses along Smith Street, as well as the adjacent pedestrian mall.

That’s where the former Chinatown Food Street was located before it lowered its shutters in 2021, amid the Covid-19 pandemic.

In part two of this two-part “On the Go” Specials of Under the Radar, Money Matters’ finance presenter Chua Tian Tian joined Carrie Wong, Director of Business Planning, Singapore Land Authority at Chinatown for a preview of the rejuvenated site.

They also discussed the features to watch out for as shops along the refreshed site progressively open.

|

|

|

|

08:35

|

MAY 27, 2025

27/05/25 - Under the Radar: (SPECIALS) What should we know about the rejuvenation of Smith Street in Chinatown? The director of business planning at Singapore Land Authority spills the beans. (Part 1 - Objectives of the rejuvenation)

In November 2023, the Singapore Land Authority, the Singapore Tourism Board, and the Urban Redevelopment Authority launched a collective tender to appoint a master tenant to rejuvenate a row of shophouses along Smith Street, as well as the adjacent pedestrian mall.

That’s where the former Chinatown Food Street was located before it lowered its shutters in 2021, amid the Covid-19 pandemic.

In part one of this two-part “On the Go” Specials of Under the Radar, Money Matter’s finance presenter Chua Tian Tian joined Carrie Wong, Director of Business Planning, Singapore Land Authority at Chinatown for a preview of the rejuvenated site.

They also discussed the challenges and objectives in giving the project site a new facelift.

|

|

|

|

11:38

|

MAY 19, 2025

19/05/25 - Under the Radar: From Ornamental fish to aquaculture and pet accessories – How is Qian Hu positioning for the future?

Have you ever tried longkang fishing, or catching fish in canals or drains as a child?

If you have, you just might be familiar with the company that we’re talking about today – Qian Hu Fish Farm.

After all, Qian Hu’s longkang fishing experience remains a core memory of many born in the 1990s.

With its beginnings as a humble fish farm in 1988, Qian Hu now looks at aquatic and pet care solutions, with a global footprint in 80 cities and countries.

The company prides itself on its expertise in ornamental fish breeding, aquaculture and pet accessories, with a focus on innovation and technology.

At its ornamental fish trading division, Qian Hu Fish Farm Trading, the firm farms, imports, exports and distributes fish, with direct exports to Singapore, Malaysia, Thailand and Indonesia. And the number of species and varieties exported – over 1,000 of them.

The industry that Qian Hu lies in is an interesting one to talk about, given Singapore's status as one of the world's top exporters of ornamental fish.

Despite its position, the market remains niche, with Singapore’s export value standing at about US$35 million back in 2022.

So who are the players within the industry, and what can ornamental fish exporters like Qian Hu do to improve its output and position for further growth in land scarce Singapore? Should they also diversify beyond ornamental fish?

Speaking of which, Qian Hu had in 2017 established an aquaculture division in the Chinese province of Hainan to farm antibiotic-free edible fish. The division has since expanded to look at farming Marbled Goby and Vannamei shrimp in Singapore.

But how has the firm’s strategic expansion into aquaculture helped it position for future growth?

On Under the Radar, Money Matters’ finance presenter Chua Tian Tian posed these questions to Yap Kok Cheng, Executive Chairman and Chief Executive Officer, Qian Hu.

|

|

|

|

27:34

|

MAY 15, 2025

15/05/25 - Under the Radar: (SPECIALS) Travelling 50 hours to Berkshire Hathaway’s Shareholder Meeting in Omaha (Part 3 - Activities to take part in as a shareholder of Berkshire Hathaway)

Earlier this year, we shared with you that we will be bringing you some on the ground reporting of key business events, launches, features or developer’s days under the “Under the Radar Specials” banner.

This time, Money Matter’s finance presenter Chua Tian Tian fulfils the promise she made, travelling over 50 hours to bring you insights from a key business event that is said to be the equivalent of a Taylor Swift concert in the world of finance – the 2025 Berkshire Hathaway Shareholder Meeting held in Omaha, in the US on the 3rd of May.

She is joined by Willie Keng, Founder, Dividend Titan.com who also attended the year’s event. The duo reflected upon their journey to the shareholder meeting as well as key highlights and nuggets of financial wisdom they gained from the “Oracle of Omaha” – Warren Buffett.

The meeting turned out to be arguably one of the most important in Buffett’s career, with the value investor making a surprise announcement to retire at the end of the year and for Vice-Chair Greg Abel to succeed him.

In part three of this three-part “On the Go” Specials of Under the Radar, Willie and Tian Tian talked about the peripheral activities shareholders can take part in during their trip to Omaha.

Link to Part 1 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-1-heading-to-omaha

Link to Part 2 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-2-warren-buffett-s-retirement

|

|

|

|

08:59

|

MAY 14, 2025

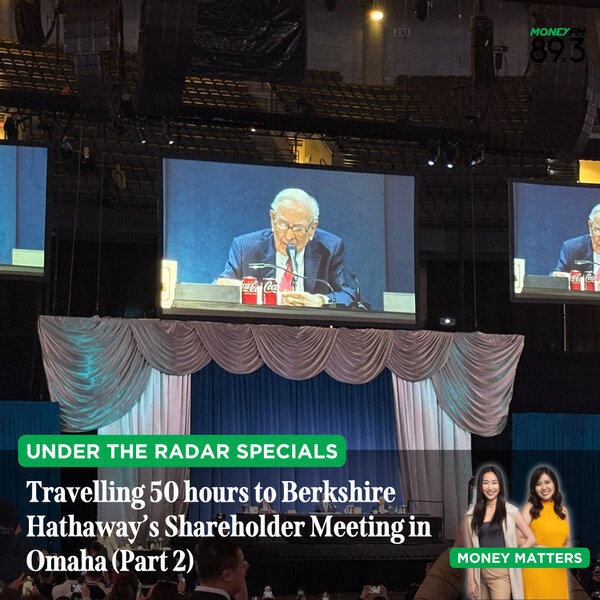

14/05/25 - Under the Radar: (SPECIALS) Travelling 50 hours to Berkshire Hathaway’s Shareholder Meeting in Omaha (Part 2 - Warren Buffett’s Retirement)

Earlier this year, we shared with you that we will be bringing you some on the ground reporting of key business events, launches, features or developer’s days under the “Under the Radar Specials” banner.

This time, Money Matter’s finance presenter Chua Tian Tian fulfils the promise she made, travelling over 50 hours to bring you insights from a key business event that is said to be the equivalent of a Taylor Swift concert in the world of finance – the 2025 Berkshire Hathaway Shareholder Meeting held in Omaha, in the US on the 3rd of May.

She is joined by Willie Keng, Founder, Dividend Titan.com who also attended the year’s event. The duo reflected upon their journey to the shareholder meeting as well as key highlights and nuggets of financial wisdom they gained from the “Oracle of Omaha” – Warren Buffett.

The meeting turned out to be arguably one of the most important in Buffett’s career, with the value investor making a surprise announcement to retire at the end of the year and for Vice-Chair Greg Abel to succeed him.

In part two of this three-part “On the Go” Specials of Under the Radar, Willie and Tian Tian discussed the highlights of this year’s shareholder’s meeting – from Warren Buffett’s retirement, to the investment guru’s take on US trade policies, its record cash pile and its investments in Apple.

Link to Part 1 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-1-heading-to-omaha

Link to Part 3 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-3-activities-to-take-part-in-as-a-shareholder-of-berkshire-hathaway

|

|

|

|

17:40

|

MAY 13, 2025

13/05/25 - Under the Radar: (SPECIALS) Travelling 50 hours to Berkshire Hathaway’s Shareholder Meeting in Omaha (Part 1 - Heading to Omaha)

Earlier this year, we shared with you that we will be bringing you some on the ground reporting of key business events, launches, features or developer’s days under the “Under the Radar Specials” banner.

This time, Money Matter’s finance presenter Chua Tian Tian fulfils the promise she made, travelling over 50 hours to bring you insights from a key business event that is said to be the equivalent of a Taylor Swift concert in the world of finance – the 2025 Berkshire Hathaway Shareholder Meeting held in Omaha, in the US on the 3rd of May.

She is joined by Willie Keng, Founder, Dividend Titan.com who also attended the year’s event. The duo reflected upon their journey to the shareholder meeting as well as key highlights and nuggets of financial wisdom they gained from the “Oracle of Omaha” – Warren Buffett.

The meeting turned out to be arguably one of the most important in Buffett’s career, with the value investor making a surprise announcement to retire at the end of the year and for Vice-Chair Greg Abel to succeed him.

In Part One of this three-part “On the Go” Specials of Under the Radar, Willie and Tian Tian discussed the preparation needed ahead of the trip, as well as what they bought at the annual Berkshire Hathaway shareholder’s shopping day.

Link to Part 2 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-2-warren-buffett-s-retirement

Link to Part 3 of our coverage on Berkshire Hathaway's 60th Shareholder Meeting: https://omny.fm/shows/moneyfm-under-the-radar/under-the-radar-specials-travelling-50-hours-to-berkshire-hathaway-s-shareholder-meeting-in-omaha-part-3-activities-to-take-part-in-as-a-shareholder-of-berkshire-hathaway

|

|

|

|

14:00

|

APR 28, 2025

28/04/25 - Under the Radar: What should we know about Southern Alliance Mining’s diversification into rare earth mining?

From undertaking sub-contracting works as an operator for limestone mines to becoming a key producer of high-grade iron ore concentrate – we’re going to take you though the ins and outs of SGX-listed Malaysian miner Southern Alliance Mining today.

The story takes us back to 2001, with the incorporation of Southern Alliance Mining’s subsidiary Honest Sam. Then, the firm was primarily involved in subcontracting works for limestone mines in the Malaysian states of Pahang and Perak.

Seven years later in 2008, the company obtained the right to become the mining operator of an open mine pit in Johor called the Chaah Mine.

The mine pit allows for the exploration, extraction and processing of iron ore that could be used by pipe coating companies in the oil and gas industry to prevent corrosion in sub-sea pipes.

Fast forward to today, Southern Alliance Mining not only offers iron ore for pipe coating. It also ventured into iron ore concentrates to diversify business risks, exporting them to markets such as China, before selling the rest to local steel mills in Malaysia.

It currently has approximately 60,000 tonnes of iron ore concentrates, not including pipe coating materials, and has produced and sold a total 6.3 million tonnes of iron ore products between 2008 and July 2021.

The firm recently also reported its earnings for the six months ended January. Revenue declined 23.8% on the year to about RM70.3 million amid weaker iron ore prices as well as slowing demand for China’s steel industry – so how concerned should we be about this?

But what is perhaps more exciting about Southern Alliance Mining is how it is positioning itself for the future.

For one thing, the firm had in April 2023 ventured into rare earth mining after inking two agreements to purchase stakes in iron absorption clay rare-earth mines in Malaysia. Again – what was the rationale behind the move, and how will the move bolster the firm from fluctuations in iron ore prices?

On Under the Radar, Money Matters’ finance presenter Chua Tian Tian posed these questions to Lim Wei Hung, Executive Director and Chief Operating Officer of Southern Alliance Mining.

|

|

|

|

31:20

|

APR 14, 2025

14/04/25 - Under the Radar: What should we know about Central Food Retail’s efforts to transform itself into a “Truly World-Class Omni-Channel Food Retail” player? Its CEO sheds light on the matter.

It’s all about food today as we bring you an inside look into what’s said to be the largest supermarket chain in Thailand. And this is a company that you might be very familiar with if you frequent the food halls at Bangkok’s malls.

With operations dating back to 1996, our guest for today is Central Food Retail Company, one of the business units under Thai multinational conglomerate Central Group.

The firm now runs supermarkets and F&B concepts in varying formats, namely: Tops Food Hall, Tops, Tops daily, Tops Online, Central Wine Cellar and Tops Eatery.

Besides that, the company also embarked on a joint venture with Japan’s drugstore chain Matsumoto Kiyoshi in 2015 to open Matsumoto Kiyoshi stores.

But why are we trying to get you hungry by speaking to Central Food Retail at this time of the day? Central Food Retail is an interesting company to talk about given how the firm announced an investment plan of 1.6 billion baht or close to S$63.2 million for 2024.

The investment was in line with the firm’s T-O-P-S strategy to position it as a Truly World-Class Omni-Channel Food Retail player, with an aim to achieve a total of 1,000 stores by 2027.

To this end, the firm is also doubling down on its investments in technology, having in December 2024 teamed up with Google Cloud to launch an AI-powered shopping assistant called ‘Tops Chef Bot’.

With the investments in place, Central Food Retail aims to achieve a compound annual growth rate of 8%. But what should we know about the firm’s progress in bridging its online to offline presence?

On Under the Radar, Money Matters’ finance presenter Chua Tian Tian posed these questions to Stephane Coum, Chief Executive Officer of Food Group, Central Retail.

|

|

|

|

32:48

|

APR 4, 2025

04/04/25 - Under the Radar: (SPECIALS) In the family business - Hong Leong Asia’s CEO on the firm’s growth, governance and succession planning processes

It’s all about family businesses today as we speak to Hong Leong Asia, a part of Singapore-based conglomerate Hong Leong Group.

The firm’s beginnings can be traced back to the early 1900s, when Hong Leong Group’s founder the late Kwek Hong Png boarded a cargo vessel in Xiamen at the age of 16, with only an $8 ticket, a straw mat, a quilt for warmth.

While life was tough, the founder held hopes of making it big in Southeast Asia as he made the arduous journey over to Singapore. That’s where he worked at a hardware store for years before starting Hong Leong in 1941.

The firm was first set up as a general trading firm dealing in ropes, paints, ship and rubber estate supplies. Eventually, the business grew to become one of Singapore’s largest conglomerates, sprawling across industries from property, hotels, financial services and trade and industry.

At its subsidiary Hong Leong Asia, the company prides itself as a diversified Asian multinational with core businesses in the construction and transportation sectors and gross assets of over S$40 billion.

Its business can be classified into two broad categories, namely building materials and powertrain solutions.

Financially, the firm had in February reported a net profit of S$38.2 million for its second half ended December, up 12.2 per cent on the year. The company’s profitability was said to be boosted by strong performances in its powertrain solutions and building materials units, amid improved market conditions in Singapore and Malaysia. But how does the firm assess the road ahead given ongoing trade tensions around the world?

Meanwhile, the issue of governance in family businesses has also come into the spotlight recently – so how does Hong Leong Asia approach the topic of governance and succession planning to ensure that the legacy of its founder lives on?

On Under the Radar, Money Matters’ finance presenter Chua Tian Tian posed these questions to Stephen Ho, Executive Director & CEO, Hong Leong Asia.

|

|

|

|

28:05

|